SAIC Motor’s finance business

Car manufacturing giant, SAIC Motor, is also a major player on the auto finance scene.

As China’s largest automaker in terms of output and sales, SAIC pays close attention to car manufacturing, making every effort to ensure the high quality of its products. Moreover, the company has always been an earnest participant in auto finance for more than 20 years, exploring possible ways to meet the diversified financial needs of both its upstream and downstream users.

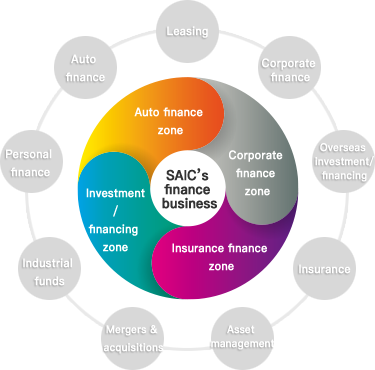

SAIC’s finance business has successfully dovetailed car manufacturing with the finance industry, and is thus capable of offering a full range of specialized, market-oriented and integrated financial services.

Centering on finance and the needs of the industrial value chain and users alike, the group has integrated its advantages, coordinated operating capabilities and launched innovative business to make its services more comprehensive. Currently, SAIC’s finance business consists of an investment holding and management company as well as six specialized financial service enterprises, which engage in services covering auto finance, corporate finance, investment funds, insurance, financial leasing and overseas financing.

Tapping financial business

Car manufacturing giant, SAIC Motor, is also a major player on the auto finance scene.

As China’s largest automaker in terms of output and sales, SAIC pays close attention to car manufacturing, making every effort to ensure the high quality of its products. Moreover, the company has always been an earnest participant in auto finance for more than 20 years, exploring possible ways to meet the diversified financial needs of both its upstream and downstream users.

SAIC’s finance business has successfully dovetailed car manufacturing with the finance industry, and is thus capable of offering a full range of specialized, market-oriented and integrated financial services.

Centering on finance and the needs of the industrial value chain and users alike, the group has integrated its advantages, coordinated operating capabilities and launched innovative business to make its services more comprehensive. Currently, SAIC’s finance business consists of an investment holding and management company as well as six specialized financial service enterprises, which engage in services covering auto finance, corporate finance, investment funds, insurance, financial leasing and overseas financing.

SAIC Motor Financial Holding Management Co

SAIC Motor Financial Holding Management Co was officially incorporated on June 6, 2016, with registered capital of 2 billion yuan. As the investment management platform for SAIC’s finance business, the new company has five major functions – strategic planning, asset management, data application, comprehensive finance service, and risk pricing. It aims to integrate resources of various financial enterprises to achieve business collaboration, forge a finance business development platform, build a comprehensive financial ecosystem and provide all-round finance solutions. It will also promote the integration of the auto industry with the finance sector to help SAIC create a new ecosystem for the motoring.

SAIC’s financial members

Today, SAIC owns six specialized financial service enterprises, offering auto finance, corporate finance, equity investment, insurance, financial leasing, and overseas investment and financing.

Shanghai Automotive Group Finance Corporation Limited (SAIC Finance)

Founded in May 1994, with registered capital of 10.38 billion yuan, SAIC Finance is a finance company with the largest asset scale and the highest annual profit in China’s car industry. Its business now covers three major areas – auto finance, corporate finance, and investment/financing. The company provides financing services to more than 370 SAIC member enterprises and over 1,900 dealerships in 370-plus cities. It has rendered inventory financing service to 4.8 million vehicles and extended auto loans to 1.2 million consumers.

SAIC-GMAC Automotive Finance Co, Ltd (SAIC-GMAC)

SAIC-GMAC, the first and largest auto finance company in China, was founded in August 2004, with registered capital of 3.5 billion yuan. Through rolling out all-round finance solutions to facilitate car sales of SAIC and GM as well as other brands, the company has been able to meet the financing needs of dealerships and consumers and maintained its leading position in the market since its launch. By the end of 2015, the company had provided consumer credit services to 2.36 million customers, and entered into retail credit cooperation with nearly 7,000 dealerships in 350 Chinese cities.

SAIC Capital Co, Ltd

SAIC Capital was founded in May 2011, with registered capital of 3.3 billion yuan. The company aims to build up SAIC Motor’s capability in the capital market, help further boost the growth of China’s leading auto enterprises, and support innovations in the car industry’s frontier projects. It also keeps a close watch on investment opportunities in other industries. Since its launch, the company has seen a steady increase in the assets under its management, with funds managed by it totaling 9.11 billion yuan at the end of 2015. So far, it has made seven industry venture-capital investments and 17 private-equity investments, and launched seven private placements, with contract values in excess of 3.6 billion yuan.

SAIC Motor Insurance Sales Co, Ltd (INSAIC)

Founded in April 2015 with registered capital of 200 million yuan, INSAIC is a professional insurance provider jointly set up by SAIC, SAIC-GM and SAIC Volkswagen. INSAIC aspires to build China’s large auto insurance platform through pursuing innovation-driven development. By taking advantage of its prime business of insurance services, the company will work out full-life-cycle and diversified solutions and construct a motoring life ecosystem centering on customers.

Anji Leasing Co, Ltd

Anji Leasing was founded in April 1993, with registered capital of 1.16 billion yuan. In 2006, the Ministry of Commerce and the State Administration of Taxation approved the company as one of the first batch of 20 qualified enterprises in a pilot program of domestically-funded financial leasing services. The company focuses on vehicle leasing and aspires to become an industry leader. As of the end of 2015, it had 68 registered employees, and its business covered more than 200 cities thanks to its fast growth.

SAIC Motor Hong Kong Investment Co, Ltd

Founded in June 2009 with registered capital of $9.9 million, SAIC Motor Hong Kong Investment Co aims to become SAIC’s overseas investment and financing platform, as well as a management platform for the group’s overseas funds. The company’s total assets reached HK$8.62 billion at the end of 2015.

SAIC finance service platform

Haocheedai.com is an Internet-based auto finance service platform that was jointly built by SAIC Finance and Anji Leasing in December 2014. As a leading enterprise in the domestic auto finance industry, Haocheedai has formed cooperative ties with several thousand dealerships across China. As of the end of 2015, the company’s auto finance service was available at 1,941 dealerships in 372 Chinese cities, with the balance of financing in excess of 50 billion yuan.

New starting point

In 2015, the SAIC Financial Division was officially launched. It takes charge of SAIC’s strategic planning, coordinated business management, optimization of assets allocation and operation in the capital market, ushering in a brand new stage in the growth of SAIC’s finance business.

SAIC’s financial blueprint

In the 13th Five-Year Period (2016-20), SAIC’s finance business will further improve the layout of the four service zones of auto finance, corporate finance, investment/financing, and insurance. It will accelerate the SAIC Motor Financial Holding Management Co’s capacity building in investment management, data application, risk pricing and relevant market mechanisms. Efforts will also be made to improve resources integration and business coordination among the financial enterprises under SAIC in order to build a comprehensive auto-finance ecosystem and help the group create a new service system in motoring.